“If” Congress and the President decide Single-Payer Healthcare is the correct replacement for Obamacare, how much will it cost?

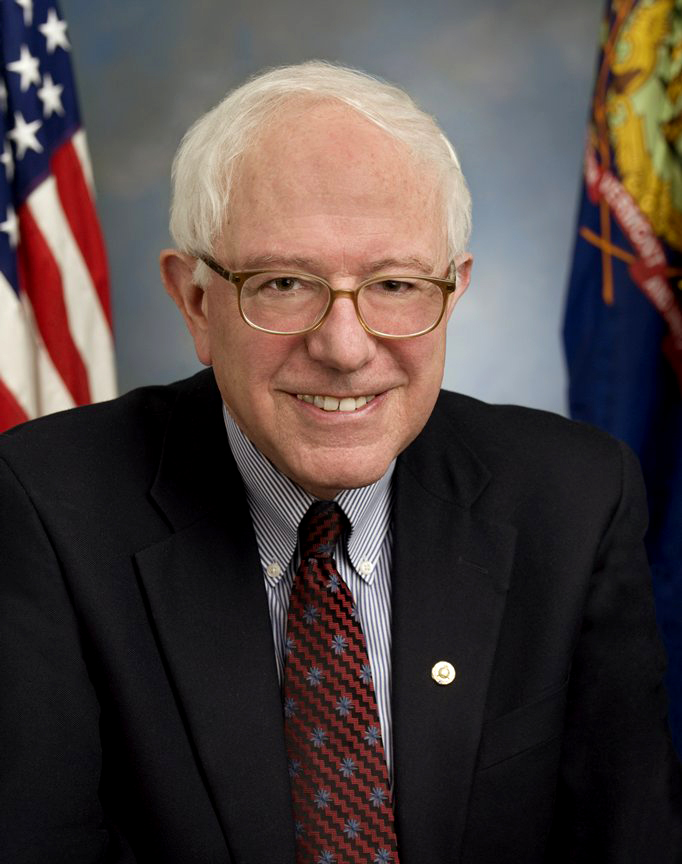

That simple question requires a not-so-simple answer. The correct answer depends on what type of program would be developed and whose numbers you choose to believe. Senator Bernie Sanders calls his proposed plan “Single-Payer,” at the same time labeling it “Medicare for All.” That is a misnomer: Medicare is NOT Single-Payer. The government currently contracts with private commercial insurance companies regionally to process Medicare claims and make payments to medical providers of all types from funds provided by CMS — “Centers for Medicare and Medicaid Services.” His proposal is similar to the modified plan used in Canada described in Part I of this topic.

How much would Senator Sanders’ program cost? Watch this Sanders discussion about Single-Payer healthcare from 1987:

Obviously the Vermont Senator has changed his tune. Does he now believe it is financially viable? And if so, what are his estimates of cost? How would it be paid for? Directly from Senator Sanders, here is the financial structure of his “Medicare for All” plan. (these numbers are all provided by Sanders):

The Plan Would Be Fully Paid For By:

- A 6.2 percent income-based health care premium paid by employers.

Revenue raised: $630 billion per year. - A 2.2 percent income-based premium paid by households.

Revenue raised: $210 billion per year.This year, a family of four taking the standard deduction can have income up to $28,800 and not pay this tax under this plan.A family of four making $50,000 a year taking the standard deduction would only pay $466 this year. - Progressive income tax rates.

Revenue raised: $110 billion a year.Under this plan the marginal income tax rate would be:- 37 percent on income between $250,000 and $500,000.

- 43 percent on income between $500,000 and $2 million.

- 48 percent on income between $2 million and $10 million. (In 2013, only 113,000 households, the top 0.08 percent of taxpayers, had income between $2 million and $10 million.)

- 52 percent on income above $10 million. (In 2013, only 13,000 households, just 0.01 percent of taxpayers, had income exceeding $10 million.)

- Taxing capital gains and dividends the same as income from work.

Revenue raised: $92 billion per year.Warren Buffett, the second wealthiest American in the country, has said that he pays a lower effective tax rate than his secretary. The reason is that he receives most of his income from capital gains and dividends, which are taxed at a much lower rate than income from work. This plan will end the special tax break for capital gains and dividends on household income above $250,000. - Limit tax deductions for rich.

Revenue raised: $15 billion per year. Under Bernie’s plan, households making over $250,000 would no longer be able to save more than 28 cents in taxes from every dollar in tax deductions. This limit would replace more complicated and less effective limits on tax breaks for the rich including the AMT, the personal exemption phase-out and the limit on itemized deductions. - The Responsible Estate Tax.

Revenue raised: $21 billion per year.This provision would tax the estates of the wealthiest 0.3 percent (three-tenths of 1 percent) of Americans who inherit over $3.5 million at progressive rates and close loopholes in the estate tax. - Savings from health tax expenditures.

Revenue raised: $310 billion per year. Several tax breaks that subsidize health care (health-related “tax expenditures”) would become obsolete and disappear under a Single-Payer Healthcare system, saving $310 billion per year.Most importantly, health care provided by employers is compensation that is not subject to payroll taxes or income taxes under current law. This is a significant tax break that would effectively disappear under this plan because all Americans would receive health care through the new Single-Payer program instead of employer-based health care.

This plan has been estimated to cost $1.38 trillion per year.

Let’s put that dollar value in perspective: the United States Government’s budget is approximately $3.8 trillion. That means Senator Sanders’ plan will cost 36.3% of the current U.S. budget total.

Let’s Break it Down

There are certain assumptions made in this and any other Single-Payer Healthcare model:

- It is “assumed” numbers are accurate. Obviously, the government financial “experts,” and private consultants who weighed in on the Sanders plan have no history of accuracy in projecting healthcare costs. If any past projections (of Obamacare as an example) are what Americans could expect, that $1.38 trillion would certainly be too low a projection;

- It is assumed in this model that current healthcare providers — physicians, facilities, pharmacists, etc. — will all agree to operate within this plan. In Canada, doctors took massive income cuts when their plan was initiated. Any suggestion otherwise is unfounded;

- Taxes, taxes, taxes. Senator Sanders in this plan taxes everybody: employers take a huge hit — 6.2% of grtoss payroll would be paid by employers. Personal income tax rates would climb for all who make $250,000 a year and above: from 37% on the low side to as high as 52%. The controversial “Death Tax” would NOT be eliminated as most feel should, the estate tax amounts would actually increase;

- Many tax deductions would disappear for those who make $250,000 or more.

The bottom line to the Sanders Plan is there is NO free ride — except for the poor. And the Middle Class and Upper Class in America would be taxed almost beyond comprehension.

Summary

Let’s be perfectly clear: this plan offered by Senator Bernie Sanders is just one concept of Single-Payer. Any such program will be driven by government payments for all healthcare costs. Remember this: the Government has NO money except what they take from taxpayers. For increased government spending, taxpayers must pay higher taxes.

Washington D.C. currently takes billions of dollars in income taxes from corporations and taxpayers and squanders a huge percent of those dollars. Financial abuse in the Government is rampant. Government financial abuse takes all kinds of shapes. There is an environment in D.C. that  fosters such abuses. American taxpayers are viewed by many in government as nothing more than a bunch of piggy banks from which to take money at will. Who thinks there is any structure in Washington that can successfully take-on a new federal program with a estimated cost that equals 36.3% of the current U.S. budget? How many Americans are ready to pay these massive additional income taxes? How many Americans — who have just just single digit approval rates of members of Congress — do you think would trust government to handle such a program? No one at my house is interested in doing so.

fosters such abuses. American taxpayers are viewed by many in government as nothing more than a bunch of piggy banks from which to take money at will. Who thinks there is any structure in Washington that can successfully take-on a new federal program with a estimated cost that equals 36.3% of the current U.S. budget? How many Americans are ready to pay these massive additional income taxes? How many Americans — who have just just single digit approval rates of members of Congress — do you think would trust government to handle such a program? No one at my house is interested in doing so.

In fairness, there are several other types of Single-Payer Healthcare programs in existence. But let’s be clear about one thing: NONE have been as successful as U.S. Healthcare. Healthcare as expensive as it is in the U.S. is still in the very top tier of healthcare in the World. Healthcare is no different than other services we use every day: you get what you pay for.

It was a huge mistake for the Democrats to ram Obamacare down the throats of Americans. It has been a dismal financial failure and has dumbed down American healthcare — and it’s getting worse. Obamacare was clearly the first step toward a Single-Payer system that those on the Left have been clamoring for since the early 90’s. But to quote the 1980’s version of Single-Payer Healthcare as defined by Bernie Sanders, doing so will bankrupt the United States.

Are you ready for that?